One small mistake in your books can lead to big trouble later.

When you’re running a small business, every dollar counts—and the wrong advice or a missed tax detail can mean penalties, cash flow problems, or a whole lot of stress with the ATO. That’s why choosing the right small business accountant in Melbourne is such a big deal.

In this guide, we’ve rounded up the best small business accountant Melbourne has to offer—so you can stay focused on growing, not fixing mistakes.

What Does a Small Business Accountant Do?

A small business accountant handles all the financial stuff you’d rather not deal with—like keeping track of expenses, managing taxes, and making sure your financial records are organized and up to date. They help you with everything from preparing your tax returns to advising on the best ways to grow your business financially.

In short, they keep your business on the right financial track. They also help with budgeting, cash flow management, and ensuring you’re taking full advantage of tax deductions. A good accountant takes a lot of the pressure off you, letting you focus more on running your business and less on worrying about your books.

What Type of Accountant is Best for Small Business?

When choosing an accountant for your small business, the best type depends on what you need. For most small businesses, a certified public accountant (CPA) or a tax accountant is usually a great choice. CPAs offer a broad range of services, like strategic planning and auditing, which can be useful as your business grows.

However, if your main concern is taxes and compliance, a tax accountant with experience working with small businesses might be the way to go. They’ll know the ins and outs of tax laws and can help you avoid any surprises come tax time. If you need more comprehensive financial advice, like setting up business structures or planning for growth, a CPA is typically the better option.

How Much Does a Small Business Accountant Cost in Melbourne?

The cost of hiring a small business accountant in Melbourne can vary based on the complexity of your needs. On average, you can expect to pay anywhere from $100 to $300 per hour, depending on the type of service. For basic tasks like bookkeeping or tax filing, you’ll likely be on the lower end of the spectrum, but for more advanced services like business consulting or audits, the cost can be higher.

Some accountants also offer fixed-rate packages, especially for businesses with a regular, predictable workload. While the cost might seem like an investment upfront, a good accountant can help save you money in the long run by reducing your tax burden and helping you avoid costly mistakes.

Now that you have a clearer idea of what a small business accountant does, which type you might need, and what the costs might be, you’re ready to find the best one for your business.

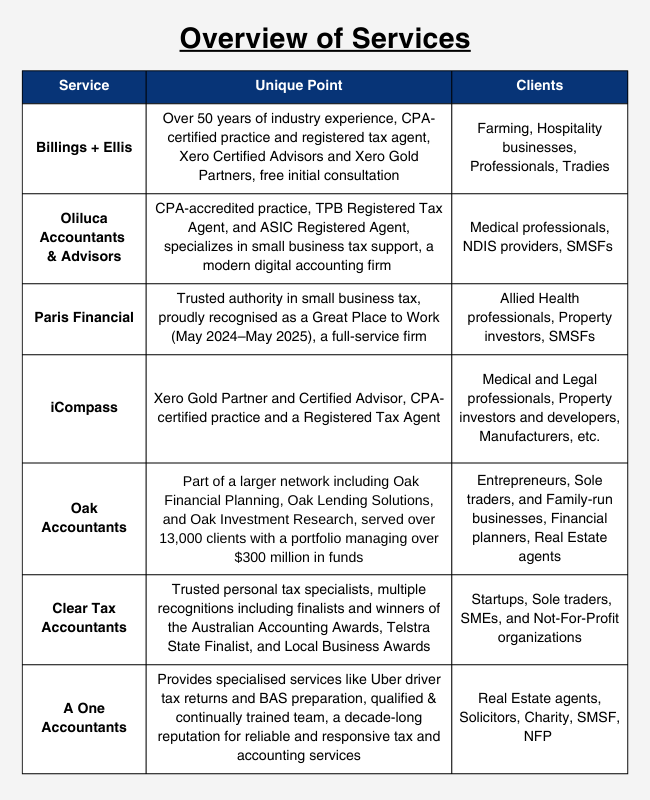

1. Billings + Ellis

Based in South Yarra, Billings + Ellis is an accounting and advisory firm with over 50 years of experience helping small and medium-sized businesses stay on top of their finances. Their services cover everything from audits and tax to cloud accounting, estate planning, superannuation, and even forensic work. They work across a mix of industries—trades, hospitality, medical, transport, IT, and farming—so they’re used to adapting their advice to fit how each business actually runs.

As a Xero Gold Partner, they make it easy for clients to stay connected to their numbers, with real-time access and smoother collaboration. They’re also members of CPA Australia and The Tax Institute, which helps keep things up to standard. Their long track record and practical, consistent approach suggest they’ve earned the trust of the businesses they work with. Communication is a clear priority, and they focus on building steady, long-term working relationships.

Services Offered:

- Auditing

- Estate Planning

- Business Advisory & Mentoring

- Financial Accounting & Compliance

- Corporate Affairs

- Cloud Accounting

- Taxation

- Self-Managed Super Fund (SMSF)

Why Choose Billings + Ellis?

Decades of Proven Experience: With over 50 years of experience, Billings + Ellis is one of South Melbourne’s most established firms for small business accounting. They continue to serve clients with distinction from their offices in South Yarra.

Comprehensive Financial Expertise: The team offers specialist support in areas such as business financial management, forensic accounting, estate planning, wealth creation, auditing, and SMSFs. Their guidance extends across a broad spectrum of industries including retail, e-commerce, construction, IT, hospitality, and more.

Professional Accreditations: Billings + Ellis is a CPA-certified practice and registered tax agent (80927009), giving clients the confidence that services meet Australia’s highest accounting standards.

Tech-Enabled Services: As Xero Certified Advisors and Xero Gold Partners, the firm leverages leading cloud accounting platforms to ensure real-time access to financial data and seamless reporting solutions.

Free Initial Consultation: New clients benefit from a no-obligation consultation, where they can explore tailored accounting and tax strategies in a relaxed, professional setting—often over a coffee in South Yarra.

Leadership You Can Trust: Featuring Graham Morris, a seasoned registered auditor and Fellow of the Taxation Institute of Australia, the firm is anchored by experienced professionals known for integrity and deep industry knowledge.

Billings + Ellis

Melbourne

Suite 8.02 Level 8, 644 Chapel Street, South Yarra VIC 3141

Phone: 03 9699 8244

Gippsland

89 Taylors Road, Koornalla VIC 3844

Phone: 0418 386 835

Email: be@billingsellis.com.au

2. Oliluca Accountants & Advisors

Oliluca Accountants & Advisors is a Melbourne-based firm that blends modern cloud-based systems with a personal touch. Named after the founder’s children, Olivia and Lucas, the firm takes a people-first approach to accounting, offering tailored support in tax, advisory, and business services. Their focus on sectors like NDIS, SMSF, medical, and small business means they’re familiar with the specific challenges these clients face—and how to navigate them.

From tax planning and CGT advice to budgeting, financial reporting, and ASIC registrations, Oliluca covers the essentials and more. They’re a CPA Accredited Public Practice, TPB Registered Tax Agent, and ASIC Registered Agent, with Xero fully integrated into their process for real-time access and smoother workflows. The firm values responsive service and clear advice, aiming to be a steady partner as clients grow and adapt over time.

Services Offered:

- Accounting & Business Advisory

- Taxation

- Self Managed Superannuation Fund (SMSF)

- Corporate Secretarial Services

Why Choose Oliluca Accountants & Advisors?

Small Business Expertise: Oliluca specialises in serving small businesses across Melbourne with tailored tax and accounting solutions. Their deep understanding of business tax obligations helps clients save both time and money.

Comprehensive Services: From GST applications and CGT advice to budgeting, financial reporting, and ASIC registrations, Oliluca offers a full suite of accounting, taxation, and advisory services suited for businesses of all sizes.

Digital-First Approach: As a modern digital accounting firm, Oliluca utilises cloud-based software to provide seamless nationwide service, allowing businesses across Australia to access top-tier financial support remotely.

Professional Credentials: Oliluca is a CPA-accredited practice, TPB Registered Tax Agent, and ASIC Registered Agent. Their qualifications reflect a strong commitment to regulatory compliance and industry standards.

Client-Centric Values: Guided by the belief that clients are more than just numbers, Oliluca prioritises professionalism, integrity, and responsiveness. Their core values include collaboration, adaptability, and long-term commitment to client success.

Tax Return Confidence: With a dedicated team that lives and breathes accounting, Oliluca simplifies the complexities of annual tax filing and minimises client stress—making them a reliable choice for small business tax support.

Oliluca Accountants & Advisors

Suite 120, 25 Milton Parade, Malvern, VIC 3144

Phone: (03) 9561 1040

Email: info@oliluca.com.au

3. Paris Financial

Paris Financial has been helping small businesses with tax and financial advice for over 45 years. What started as Butler & Mannix has grown into a full-service firm offering support in accounting, tax, private wealth, lending, SMSFs, and risk protection. Built on strong family values and a steady approach, the firm has also been named a ‘Great Place to Work,’ highlighting the way they look after both their clients and team.

The team includes CPAs, Chartered Accountants, and Certified Financial Planners, giving clients solid expertise across different areas. As a Corporate Authorised Representative of Capstone Financial Planning, they also offer more advanced financial advice when needed. Paris Financial uses a mix of trusted accounting tools to keep things running smoothly, helping clients stay organised while getting support that actually fits their goals.

Services Offered:

- Taxations

- Private Wealth

- Lending & Finance

Why Choose Paris Financial?

Small Business Tax Specialists: With over 45 years of experience, Paris Financial has built a reputation as Melbourne’s trusted authority in small business tax, offering tailored advice to businesses at every stage—from startups to mature enterprises.

Tailored Tax Solutions: Their tax planning strategies are crafted to meet the unique needs of different business types, including guidance for restructuring, cost-saving solutions for growing companies, and future-proofing strategies for established businesses.

Family Values & Legacy: Originally founded by Pat and Noel as Butler & Mannix, the firm was built on traditional values and a passion for helping small businesses. That commitment continues today through a client-focused, relationship-driven approach.

Full-Service Firm: Beyond tax, Paris Financial provides integrated support across accounting, private wealth management, risk protection, lending, and SMSF specialisations—making it a one-stop solution for business finance.

Certified Workplace Excellence: Proudly recognised as a Great Place to Work (May 2024–May 2025), Paris Financial fosters a positive, feedback-driven culture that supports innovation and professional growth—ensuring clients are served by engaged, top-tier talent.

Paris Financial

East Melbourne

Level 2, 128 Jolimont Road East Melbourne Victoria 3002

Phone: 03 8393 1070

Blackburn

Suite 5, 2-6 Albert Street Blackburn Victoria 3130

Phone: 03 8393 1000

Email: champions@parisfinancial.com.au

4. iCompass

iCompass is a boutique accounting firm in Preston that works with small and medium-sized businesses to keep their finances clear and on track. Their team includes Certified Practising Accountants, Registered Tax Agents, and Xero Gold Champion Partners, offering tax compliance, bookkeeping, business advice, financial planning, and SMSF services. They’re also known for their fixed-price packages, which make costs easier to manage, and their experience across industries like hospitality, construction, medical, legal, and retail.

With cloud-based systems like Xero, clients get real-time access to their numbers and a more streamlined way to stay organised. Startups receive focused support too, with help on business structuring, tax planning, and cash flow. Their approach is grounded in responsive service, clear communication, and a steady commitment to building long-term partnerships.

Services Offered:

- Small Business Accounting

- Medium Business Services

- Startup Accounting

- Bookkeeping

- Self-Managed Super Fund (SMSF)

- Financial Planning

- Business Consulting

- Virtual CFO Services

- Xero Cloud Accounting

- Industry-Specific Accounting

Why Choose iCompass?

Real-World Expertise: iCompass offers practical, real-life accounting, tax, and business advice that resonates with both small businesses and individual clients. Their guidance is tailored to add real value, not just tick compliance boxes.

Trusted by Businesses Nationwide: From startups to established medium-sized businesses across Australia, iCompass provides professional advice that helps clients start strong, recover from setbacks, and scale successfully.

Certified Xero Gold Partner: As a Xero Gold Partner and Certified Advisor, iCompass leverages cloud-based accounting technology to simplify tax compliance and business operations—anytime, anywhere.

Respected Credentials: iCompass is a CPA-certified practice and a registered tax agent (00566015), ensuring all services are backed by recognised qualifications and professional integrity.

Client-Centred Support: The firm is committed to guiding clients through every stage of their business journey with a clear focus on practical outcomes, efficient processes, and consistent growth.

iCompass

Corporate One Building, 84 Hotham Street, Preston VIC 3072

Phone: 1300 554 948

Email: enquiries@icompass.com.au

5. Oak Accountants

Oak Accountants works with small and medium-sized businesses, offering tax, accounting, and advisory services through offices in Kew, Kew East, and Boronia. Their services cover year-end tax planning, asset protection, business acquisitions, SMSF, retirement advice, and succession planning. With close ties to Oak Financial Planning, Oak Lending Solutions, and Oak Investment Research, clients get well-rounded support across tax, lending, and investment—all in one place.

Led by Chartered Accountants like Steve Harris and Linda Battye, the team brings solid experience and a practical, client-focused approach. They’re known for being easy to talk to and clear in their advice—something clients value when making financial decisions. New clients can also book a free first consultation to understand how the team works and what support they can offer moving forward.

Services Offered:

- Year-End Taxation Planning

- Structuring for Asset Protection

- Taxation & Accounting Compliance

- Buying a Business

- Preparing Business for Sale

- Retirement Planning & SMSF

- Corporate Governance

- Succession Planning

- Business Start-Up Strategy

Why Choose Oak Accountants?

Client-Centred Service: Oak Accountants delivers truly personalised service by recognising that every client has unique accounting and tax needs. Their approach emphasises collaboration over silos, ensuring advice is always well-rounded and relevant.

Integrated Financial Network: As part of a larger network including Oak Financial Planning, Oak Lending Solutions, and Oak Investment Research, Oak Accountants offers clients seamless financial solutions that cover property, finance, accounting, and lending across three Melbourne locations—Melbourne, Kew East, and Boronia.

Small Business Focus: Specialising in small to medium-sized businesses, Oak Accountants brings a deep understanding of business challenges, supported by a collaborative, versatile, and hardworking culture that shines through in every client interaction.

Proven Track Record: Established in 2008, Oak Accountants has grown to serve over 13,000 clients with a team of 45 professionals and a portfolio managing over $300 million in funds under management.

Efficient & Friendly Service: Clients can always expect professional service, quick response times, and a consistently friendly and helpful team ready to support business growth.

Oak Accountants

Head Office

Lvl 3, 35 Cotham Road, Kew VIC 3101

Phone: 03 9859 8791

Fax: 03 9859 8701

Boronia

Suite 1, 18-20 Floriston Road, Boronia VIC 3155

Phone: 03 9762 4000

Email: enquiries@oakaccountants.com.au

6. Clear Tax Accountants

Clear Tax Accountants helps individuals, startups, and small businesses stay on top of their tax and accounting. Founded by Yuvraj Verma and Ash Jindal, the team brings experience from Ireland, the UK, and Australia, offering support in tax returns, planning, bookkeeping, business structuring, SMSF advice, and virtual CFO services. They also offer tailored packages for startups, covering everything from setup to compliance and growth planning.

The firm uses cloud-based tools like Xero, MYOB, and QuickBooks to give clients real-time access to their numbers and make collaboration simple. With offices in Richmond, Pakenham, Point Cook, Cranbourne, Sydney, and Adelaide, they work with businesses across Australia. Clients often mention how easy the team is to work with, noting their clear advice, fast replies, and steady support over time.

Services Offered:

- Taxations

- Accounting

- Business Advisory

- Self-Managed Super Fund (SMSF)

- Virtual CFO

Why Choose Clear Tax Accountants?

Comprehensive Support for Businesses: Clear Tax offers more than tax returns—they provide holistic financial services including bookkeeping, specialist advice, and tailored business advisory for Melbourne startups, small businesses, and medium enterprises.

Award-Winning Service: With multiple recognitions including finalists and winners of the Australian Accounting Awards, Telstra State Finalist, and Local Business Awards, Clear Tax is celebrated for excellence across the accounting industry.

Client Results That Matter: Over 2,600 clients have benefited from Clear Tax’s services, with an average savings of $25,440, $8.5 million secured in government grants, and 98.4% of calls responded to within 24 hours.

Cloud-Based Accounting Technology: As experts in Xero and QuickBooks, Clear Tax leverages cloud technology for real-time reporting, ensuring businesses have accurate financial data for smarter decisions and scalable growth.

Trusted Personal Tax Specialists: The team helps optimise individual tax positions, ensuring all eligible deductions are claimed. They also provide assistance for overdue lodgements and tax debt resolution.

Clear Tax Accountants

418 Church St, Richmond VIC 3121

Phone: 1300 417 399

Email: sales@cleartax.com.au

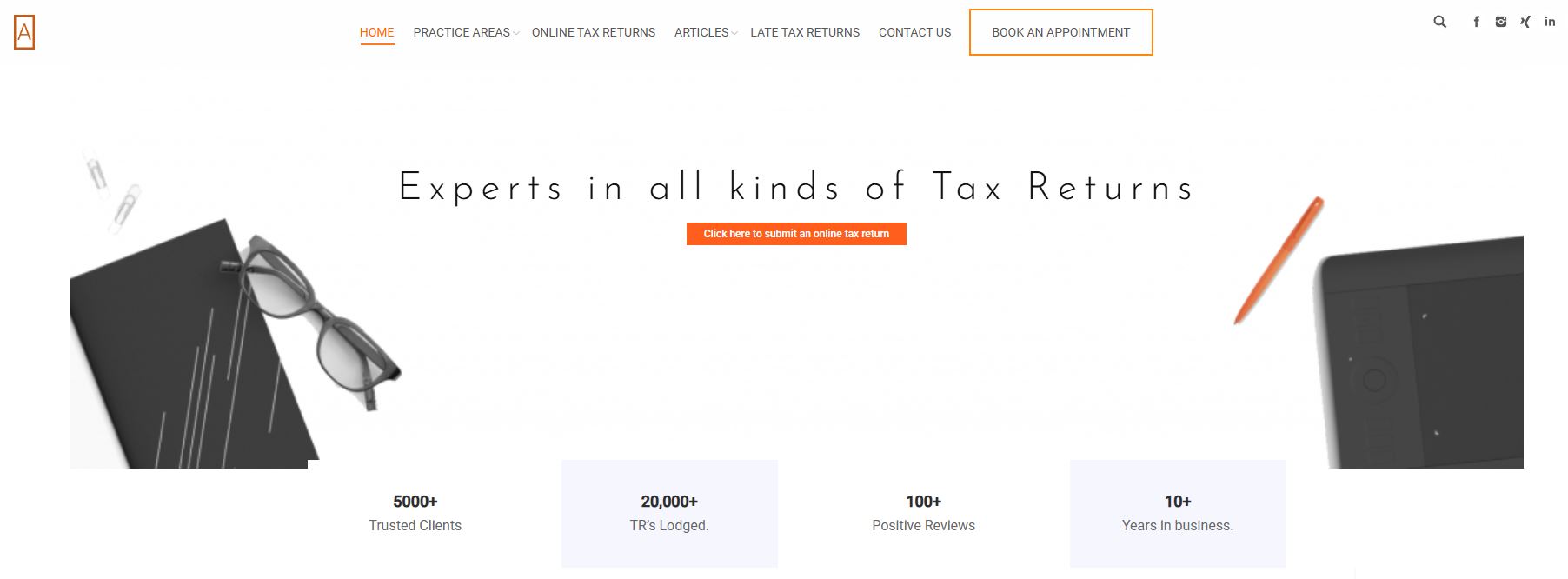

7. A One Accountants

A One Accountants offers tax, accounting, and advisory services for individuals, startups, and small to medium-sized businesses. With offices in Melbourne CBD and Truganina, their team handles business and individual tax returns, bookkeeping, financial forecasting, SMSF services, audits, and company setups. Everyone on the team is locally qualified and regularly trained to keep up with changes in tax laws and what clients actually need.

They work with businesses in hospitality, medical, IT, and real estate, offering practical advice on tax planning, compliance, and day-to-day finances. As Xero-certified and QuickBooks Pro Advisors, they use cloud-based tools to keep things simple and collaborative. Clients often mention how responsive and professional the team is, and appreciate the fair pricing. Startups also get extra support, including a free first consult, business structuring advice, and help staying on top of budgets and requirements.

Services Offered:

- Tax Returns

- Accounting

- Audit & Assurance

- SMSF

- Business Plans

- Bookkeeping

- Advisory

- Company & Trust Formations

Why Choose A One Accountants?

Proven Client Satisfaction: With over 5,000 trusted clients, more than 20,000 tax returns lodged, and 100+ positive reviews, A One Accountants has built a decade-long reputation for reliable and responsive tax and accounting services in Melbourne.

Smart, Not Just Hard Work: The firm is built on the principle of smart work—streamlining financial tasks with clear, practical solutions. Their accountants go beyond traditional number-crunching by helping clients understand and manage their financial futures effectively.

Personalised, Value-Based Approach: A One Accountants prioritises long-term relationships, value over volume, and personal engagement. They don’t charge hourly or for general consultations, making professional support accessible and pressure-free.

Support for Gig Economy Professionals: Specialised services like Uber driver tax returns and BAS preparation demonstrate their commitment to modern, flexible working professionals. Clients are guided through deductions and compliance with the ATO.

Comprehensive Financial Expertise: Services include bookkeeping, tax for individuals and businesses, SMSF audits, business structuring, and strategic planning. They support clients at every stage—from launching a business to succession planning and compliance.

Qualified & Continually Trained Team: All accountants are degree-qualified from Australian universities and receive ongoing training and coaching to stay ahead of regulatory and industry changes.

A One Accountants

Head Office

Level 3, Suite 311/343 Little Collins Street, Melbourne VIC 3000

Phone: 03-86091889, 03-88997736

Fax: 0386091890

Truganina Branch Office

Sapphire Square Shopping Centre, 0/45 Tallis Circuit, Truganina

Phone: 03-86091889

Fax: 03-86091890

Should a Small Business Hire an Accountant?

Yes—especially if you want to avoid financial headaches down the road. While it’s possible to handle some of the basics on your own when you’re just starting out, managing finances can quickly become overwhelming as your business grows. Hiring a small business accountant means you’ll have someone who knows exactly how to keep your books in order, stay compliant with tax rules, and help you make better financial decisions. It’s about making your life easier and giving you the confidence that things are being done right.

Do Small Businesses Need Accounting Software?

In most cases, yes. Accounting software can help you stay organized, track your expenses, and get a clear picture of your business finances. It’s especially useful for sending invoices, managing payroll, and reconciling bank accounts. Even if you’re working with an accountant, having accounting software in place makes collaboration smoother and more efficient. Many small business accountants in Melbourne are familiar with popular platforms like Xero or MYOB, so they can jump right in and work with whatever system you’re using.

How Can a Business Owner Benefit from Hiring a Small Business Accountant?

Hiring a small business accountant isn’t just about keeping your finances in check—it’s about setting your business up for long-term success. A good accountant can help you save money on taxes, spot areas where you’re overspending, and provide advice on how to grow your business in a sustainable way. They’re also a reliable sounding board when you need to make big financial decisions. Having that kind of support can be a game-changer, especially when you’re juggling multiple responsibilities as a business owner.

Conclusion

Running a small business is hard enough—you don’t need financial stress weighing you down too. With the right accountant on your side, your numbers make sense, your deadlines are met, and you’re free to focus on what you actually love doing. The firms on this list get what it means to support small businesses in Melbourne. If you’re ready to stop guessing and start building with confidence, now’s a good time to make that call.