The wrong home loan can haunt you for years.

Between confusing rates, endless fine print, and bank jargon, it’s easy to feel overwhelmed—especially when you’re making one of the biggest financial decisions of your life. Without the right support, you could end up locked into a deal that doesn’t actually work for you.

That’s where a home loan broker in Melbourne comes in. Also known as mortgage brokers, they’re here to make sure you get the best possible deal. In this post, we’ve rounded up the best home loan broker Melbourne has to offer, so you can make the smartest decision without the stress.

What is a Home Loan Broker?

A home loan broker is a professional who helps you find the right home loan by comparing different options across various lenders. They’re not tied to any one bank, which means they have access to a range of products, rates, and terms. Their job is to guide you through the process, from finding a loan that suits your needs to handling paperwork and making sure everything runs smoothly.

Is It Better to Go to a Bank or a Mortgage Broker?

It really depends on your needs, but generally speaking, working with a mortgage broker can give you more flexibility. While banks can only offer their own loan products, brokers have access to a variety of lenders and loan options, which could lead to better deals. Brokers can also help you navigate the paperwork and negotiate terms, potentially saving you time and money. On the other hand, if you have a solid relationship with a bank and they offer competitive rates, it might be easier to go directly to them.

How Much Does a Home Loan Broker Cost?

Most home loan brokers in Melbourne don’t charge you directly. Instead, they’re usually paid by the lender once you secure a loan. This means that their services are typically free for you to use. However, it’s always a good idea to ask up front about any potential fees or charges, especially if your loan application is more complex. Many brokers work on a commission-based structure, so their primary incentive is finding you a great deal.

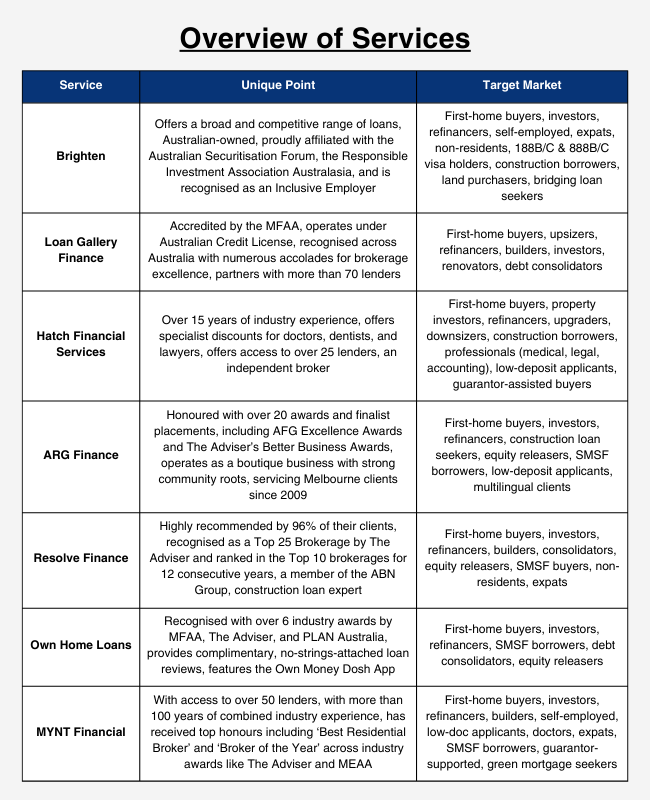

Now that you know what a home loan broker does, what to expect in terms of cost, and how they compare to banks, let’s take a look at some of the best home loan brokers in Melbourne.

1. Brighten

Brighten Home Loans is a dynamic, Australian-owned non-bank lender that entered the scene in 2017 with a fresh approach to lending. Operating out of major cities like Sydney, Melbourne, and Brisbane, as well as Hong Kong and Shanghai, Brighten handles everything from application and credit checks through to funding and ongoing loan servicing. Their funding strategy cleverly taps into diverse channels, including warehouse arrangements with major banks and publicly issued RMBS programs, setting them apart in flexibility and innovation.

Known for specialised home loan products, Brighten caters specifically to those often overlooked by traditional banks—self-employed individuals, expatriates, non-residents, and property investors—with popular loan options like Brighten Elevate and Brighten Evergreen. Holding an Australian Credit Licence, Brighten takes transparency seriously, clearly outlining fees upfront and supporting clients through an expert team and user-friendly digital tools.

Services Offered:

- Full Doc Home Loans

- Alt Doc Home Loans

- Expatriate Home Loans

- Non-Resident Home Loans

- Premium Home Loans (for 188B/C or 888B/C Visa holders)

- Bridging Loans

- Construction Loans

- Vacant Land Loans

Why Choose Brighten?

Superior Product Offering: Brighten offers a broad and competitive range of Full Doc, Alt Doc, and Construction loans, catering to Prime, Near Prime, Expat, and Non-Resident buyers.

Fast Turnaround Times: Applications benefit from swift service-level agreements (SLAs), backed by Brighten’s experienced team and proprietary cloud-based loan origination platform.

Industry Recognition: The company has received numerous accolades, including awards from The Adviser, Australian Broker, and Australian Mortgage Awards for excellence in lending and innovation.

One Loan, One Tree Commitment: For every home loan settled, Brighten plants a tree that is legally protected for 100 years, demonstrating its long-term commitment to environmental sustainability.

Memberships and Initiatives: Brighten is proudly affiliated with the Australian Securitisation Forum, the Responsible Investment Association Australasia, and is recognised as an Inclusive Employer (2023–2024). It is also a partner in the Carbon Neutral Plant-A-Tree Program.

Locally Grounded, Globally Backed Lending Expertise: Brighten is an Australian-owned, non-bank lender with international backing and offices in Sydney, Melbourne, Brisbane, Hong Kong, Shanghai, and Manila. It offers a full suite of loan products and manages origination, underwriting, servicing, and funding in-house.

Brighten

Level 46, Rialto South Tower 525 Collins Street Melbourne VIC 3000 Australia

Phone: +61 131488

Email: info@brighten.com.au

2. Loan Gallery

Loan Gallery Finance is an Australian mortgage brokerage known for making the lending process simpler and more personal. Built around straightforward values like teamwork and integrity, the team takes the time to genuinely understand each client’s situation. It’s an approach that’s led them to consistent recognition, including being named AFG’s Top Performing Brokerage in VIC/TAS for eight years in a row—reflecting their commitment to solid results and strong relationships.

From first-home purchases and refinancing to construction loans, property investments, and debt consolidation, Loan Gallery Finance offers comprehensive lending services. With access to over 70 lenders and nearly 10,000 loan products, the brokerage ensures clients have plenty of practical options tailored to their goals. Accredited by the Mortgage & Finance Association of Australia (MFAA) and fully licensed (Australian Credit Licence), the company keeps things transparent, offering ongoing support and clear, helpful advice throughout the financial journey.

Services Offered:

- First Home Buyer Loans

- Refinancing

- Upsizing Loans

- Construction Loans

- Home Improvement Loans

Why Choose Loan Gallery Finance?

Award-Winning Expertise: Recognised across Australia with numerous accolades for brokerage excellence, innovation, and service, including finalist and winner titles from major industry bodies.

Highly Experienced Team: A professional group of over 50 finance experts with deep knowledge in lending, offering clients informed and strategic financial guidance.

Access to an Extensive Lender Network: Partners with more than 70 lenders and offers close to 10,000 loan products, providing unmatched choice and flexibility.

Smart Financial Tools: Features user-friendly online calculators to help clients estimate borrowing power, plan budgets, and understand repayment scenarios.

Trusted by Major Banks: Works with leading Australian lenders such as ING, ANZ, NAB, Commonwealth Bank, and more to secure competitive loan options.

Proven Track Record: Established in 2012 with a strong growth history and a reputation for excellence, particularly in Victoria and Tasmania through repeated top performer awards.

Loan Gallery

Level 1, 126 Bertie Street, Port Melbourne, Victoria 3207

Phone: 03 9495 5000

Email: hello@loangallery.com.au

3. Hatch Financial Services

Hatch Financial Services is a boutique mortgage brokerage based in Malvern East, Victoria, established in 2005 by Tim Gaspar. With over a decade of industry experience and approximately $350 million in settled loans, Tim and his team offer tailored financial advice that genuinely aligns with clients’ personal circumstances. Hatch’s focus is straightforward: understanding what clients need and helping them navigate the mortgage process clearly, from start to finish.

Their services cover first-home buying, refinancing, investment loans, commercial property finance, and even specialised loans for professionals like doctors and lawyers. With access to more than 25 lenders, Hatch ensures clients get practical, competitive options without hidden surprises—services are transparent and typically free, aside from standard fees like legal costs for property purchases. Accredited under an Australian Credit Licence, the Hatch team provides reliable, ongoing support even after loan settlement, backed by deep expertise in the Melbourne property market.

Services Offered:

- First Home Buyer Loans

- Low Deposit Home Loans

- Home Loan Advisory Service

- Home Loan & Mortgage Refinance Advice

- Home Renovation Loans

- Construction Loans

- Home Loans for Professionals

- Doctor Home Loans

- Investment Property Loans

- Upsizers & Downsizers Loans

Why Choose Hatch?

No Cost to You: Services are completely free for clients, helping them save money without paying any broker fees.

Flexible Meeting Options: Appointments can be arranged at a time and place convenient to the client—even during evenings or after hours.

Broad Lender Access: Offers access to over 25 lenders, providing a diverse range of loan products and structures for different needs.

Independent Advice: As an independent broker, provides unbiased recommendations by comparing loans from multiple lenders to find the best match.

Specialist Discounts: Doctors, dentists, and lawyers may qualify for exclusive home loan savings from selected lenders.

Proven Experience: Over 15 years of industry experience with more than 1,800 loans settled and over $330 million in total lending.

Trusted Lender Partnerships: Works with top banks including Commonwealth Bank, ANZ, NAB, Westpac, ING, Macquarie, and others to offer competitive lending options.

Hatch Financial Services

409a Wattletree Rd Malvern East VIC 3145

Phone: 1300 442 824

Email: tim@hatchfs.com

4. ARG Finance

ARG Finance is a Melbourne-based mortgage and finance brokerage that focuses on making finance clear and personalised. They help clients across Australia navigate everything from home loans, refinancing, and debt consolidation, to commercial property loans, business financing, asset finance, and vehicle loans. The team prides itself on listening closely and guiding clients smoothly through the loan process, ensuring the options fit each person’s unique financial situation.

With connections spanning major banks, specialist lenders, and non-bank institutions, ARG Finance can offer a wide range of loan products with competitive rates and flexible terms. Clients appreciate their transparency about fees, including upfront details on application costs, valuations, and potential exit charges. The brokerage has earned a solid reputation through strong client reviews that regularly highlight their professionalism, responsiveness, and dedication. Fully licensed and committed to industry best practices, ARG Finance also provides handy online tools like loan calculators to help clients make informed decisions.

Services Offered:

- First Home Buyer Loans

- Refinancing Loans

- Debt Consolidation Loans

- Bridging Loans

- Construction Loans

- Home Improvement Loans

- Equity Home Loans

- Property Investment Loans

Why Choose ARG Finance?

Extensive Industry Expertise: Boasts over 15 years of experience in mortgage and finance broking, guiding clients with deep industry insight.

Award-Winning Recognition: Honoured with over 20 awards and finalist placements, including AFG Excellence Awards and The Adviser’s Better Business Awards.

Wide Range of Loan Options: Accesses a broad lender network—covering banks, non-bank lenders, and second-tier institutions—to match clients with suitable financing solutions.

Free Consultations and Mobile Service: Offers complimentary consultations and is flexible with location and timing, including after-hours availability.

Local Melbourne Expertise: Operates as a boutique business with strong community roots, servicing Melbourne clients since 2009.

Start-to-Finish Support: Offers full guidance throughout the loan process for all types of borrowers, from first-time buyers to experienced investors.

Trusted Lending Partners: Collaborates with reputable lenders such as ING DIRECT, La Trobe Financial, Liberty, MKM Capital, ME Bank, and Heritage Bank.

ARG Finance

Unit 10/202-220 Ferntree Gully Road, Notting Hill, Melbourne, VIC 3168

Phone: 1300 511 655

Email: info@argfinance.com.au

5. Resolve Finance

Resolve Finance is an established Australian mortgage brokerage that’s been making home finance clearer and easier since 1997. Part of the respected ABN Group, the brokerage has helped over 36,000 Australians navigate their loan journeys. Resolve is especially recognised for its expertise in construction finance, managing around one in every 20 construction loans in WA and Victoria. Beyond construction loans, the company offers home loans, refinancing, personal and car loans, commercial finance, and even has its own specially designed loan products. Clients get access to more than 30 different lenders, which means plenty of practical, competitive options tailored to their financial goals.

Transparency and ethical lending practices matter a lot to the Resolve team. Their brokers all hold Diplomas in Financial Services, are MFAA accredited, and regularly update their skills to keep up with industry developments. Resolve Finance also provides helpful online tools like loan calculators to assist clients in making informed decisions. Feedback from clients often highlights the team’s personalised approach and ongoing support, even long after settlement. With offices in Perth, Bunbury, and Melbourne, Resolve Finance combines local market insight with straightforward guidance to deliver advice that fits regional trends and client needs.

Services Offered:

- First Home Buyer Loans

- Next Home Loans

- Home Loan Refinancing

- Construction Loans

- Investment Property Loans

- Property Development Loans

- Low Deposit Loans

- Debt Consolidation Loans

- Resolve Home Loans (proprietary loan products)

- My Home Plan (financial coaching and planning)

Why Choose Resolve Finance?

Proven Client Satisfaction: 96% of customers highly recommend Resolve Finance, reflecting consistent service quality and positive outcomes.

Award-Winning Track Record: Recognised as a Top 25 Brokerage by The Adviser and ranked in the Top 10 brokerages for 12 consecutive years.

Trusted Heritage: A member of the ABN Group, Resolve has financed over 36,000 homes and helped thousands of clients since its establishment in 1997.

Construction Loan Expertise: Over 80% of loans written are construction loans, making Resolve one of Australia’s leading specialists in the field.

Strong WA and VIC Presence: Established in Western Australia and expanded into Victoria in 2008, Resolve now helps over 200 new homebuyers each month.

Flexible Meeting Options: Consultations are available at home, in cafés, or at office locations—whatever suits the client’s preference.

Resolve Finance

81 Lorimer Street, Docklands, VIC 3008

Phone: (03) 9674 4590

Email: info@resolvefinance.com.au

6. Own Home Loans

Own Home Loans is a mortgage brokerage based in Melbourne, focused on helping Australians become homeowners faster. The team believes homeownership should be within everyone’s reach, so they provide tailored strategies designed to help clients pay off their mortgages sooner and stay on track financially. Their services don’t cost clients anything—commissions from lenders cover the fees—which means the advice provided stays impartial and relevant to each individual’s goals.

Their range of services covers first-home buyer loans, refinancing, investment properties, car and equipment finance, and even self-managed super fund (SMSF) lending. Clients can also access financial planning and money coaching through Own Money, their partnered platform. The brokerage prioritises transparency by clearly explaining any potential costs linked to refinancing, like exit fees or government charges. Backed by a strong track record, numerous 5-star reviews, and several industry awards, Own Home Loans ensures clients have the right information and tools, such as online repayment and borrowing calculators, to confidently make financial decisions. Fully licensed, they maintain high standards and reliability at every step.

Services Offered:

- First Home Buyer Loans

- Investment Property Loans

- Home Loan Refinancing

- Mortgage Acceleration Strategies

- Self-Managed Super Fund (SMSF) Property Loans

Why Choose Own Home Loans?

Specialist Team Support: Backed by a dedicated team of 8 mortgage specialists who guide clients through every step of the homeownership journey.

Proven Lending Experience: Has successfully funded over 988 home loans, helping Australians achieve their property goals with confidence.

Zero Broker Fees: Offers expert mortgage services at no cost, with clients gaining access to loan solutions without paying any upfront fees.

Free Loan Reviews: Provides complimentary, no-strings-attached reviews to ensure clients are on the best possible loan for their situation.

Smart Financial Tools: Features the Own Money Dosh App, enabling clients to manage finances, track goals, and monitor property equity in one place.

Trusted Lending Partners: Works with respected lenders including Bankwest, Bank of Melbourne, Better Choice, Beyond Bank, Bluestone, and others.

Multi-Award-Winning Team: Recognised by institutions like MFAA, The Adviser, and PLAN Australia with accolades for customer service, finance, and business excellence.

Own Home Loans

Office 2, 484 Mt Alexander Rd, Ascot Vale Vic 3032

Phone: 1300 721 631

Email: ownit@ownhomeloans.com.au

7. MYNT Financial

Mynt Financial is a Melbourne-based mortgage brokerage founded in 2011, known for its personal approach and innovative lending solutions. Led by Managing Director Josh Bartlett—who has personally settled over $2 billion in loans—the team has quickly grown into one of Australia’s leading brokerages. They’ve been recognised nationally, ranking within the top 1% of brokerages, thanks largely to a clear focus on understanding individual client needs and delivering practical results. Their unique Mynt Savers program also helps aspiring homeowners boost their savings, making home ownership achievable sooner.

Offering a wide range of services from home loans, refinancing, investment and construction financing, to specialised lending for doctors, expats, and self-employed professionals, Mynt Financial gives clients plenty of flexible choices. With access to more than 50 lenders, their experienced team, including Co-Director Kristy Bartlett who brings over 25 years in real estate and finance, guides clients with straightforward advice. With their Australian Credit Licence, Mynt emphasises transparency and professionalism, which contributed to its recent recognition as a 5-Star Mortgage Innovator by Australian Broker. Additionally, their easy-to-use online calculators and ongoing support after settlement ensure clients stay informed and confident every step of the way.

Services Offered:

- First Home Buyers

- Refinancing

- Loans to Build a New Home

- Property Investment Loans

- Self-Employed Loans

- Low-Doc Loans

- Home Loans for Doctors

- Australian Expat Home Loans

- Guarantor Loans

- Green Mortgages

- SMSF Loans

- Mortgage Protection Insurance

Why Choose MYNT Financial?

Extensive Lending Panel: With access to over 50 lenders, MYNT Financial offers clients more choice and stronger negotiation power when securing a loan.

Impressive Lending Volume: Over $2 billion has been lent Australia-wide, reflecting the firm’s scale, reach, and capacity to handle diverse financing needs.

Expert-Led Team: With more than 100 years of combined industry experience, MYNT brings seasoned expertise under one roof to support clients at every step.

No-Cost Service Model: Clients benefit from comprehensive mortgage services without any direct fees, making expert support accessible to all.

Award-Winning Recognition: MYNT Financial has received top honours including ‘Best Residential Broker’ and ‘Broker of the Year’ across industry awards like The Adviser and MEAA.

Smart Mortgage Calculators: Clients can use a full suite of tools, including borrowing power, repayment, rent vs. buy, and stamp duty calculators, to plan their finances with ease.

MYNT Financial

308a Bay Road, Cheltenham VIC 3192

Phone: 03 8555 2017

Email: josh@myntfinancial.com.au

Why Do You Need a Mortgage Broker to Help You?

Buying a home is a big move, and there’s a lot of paperwork, terms, and financial details that can get overwhelming. A mortgage broker helps make the process easier by comparing loan options for you, breaking down the fine print, and helping you find something that actually fits your budget and goals. They take a lot of the stress out of applying for a home loan and often have insights into deals or lenders you might not find on your own.

How Do Home Loan Brokers Get Paid?

Most mortgage brokers in Melbourne earn a commission from the lender once your loan is approved and settled. This means you don’t usually have to pay them directly for their service. Some brokers might charge a small fee in more complex cases, but they’ll usually be upfront about it before you commit to anything. Because they’re paid by the lender, it’s in their best interest to help you secure a loan that works.

Is It Worth Paying a Mortgage Broker?

In most cases, you won’t be paying out of pocket—but even if a small fee is involved, the value you get from a good mortgage broker can outweigh the cost. They save you time, help you avoid costly loan mistakes, and often secure better rates than if you were to go it alone. For many homebuyers, the peace of mind alone makes it worth it.

Conclusion

Buying a home is a huge step, and the last thing you need is loan regret. With the right home loan broker in Melbourne, you’re not just comparing numbers—you’re getting real guidance from someone who understands the stakes and knows how to find the deal that fits you. The brokers on this list are here to make the process less overwhelming and way more manageable.

So if you’re ready to make smart moves with your money—and finally stop stressing about loan terms—start with one of Melbourne’s best.