If you’re running your own business in Melbourne, at some point you’ve probably asked yourself: Do I really need an accountant, and how much will it set me back?

Hiring a small business accountant in Melbourne can save you from a ton of stress—especially when tax deadlines are looming or you’re trying to figure out if your business is actually making money.

Let’s break down what you’re likely to pay, what affects the cost, and what sneaky extras could show up on your invoice.

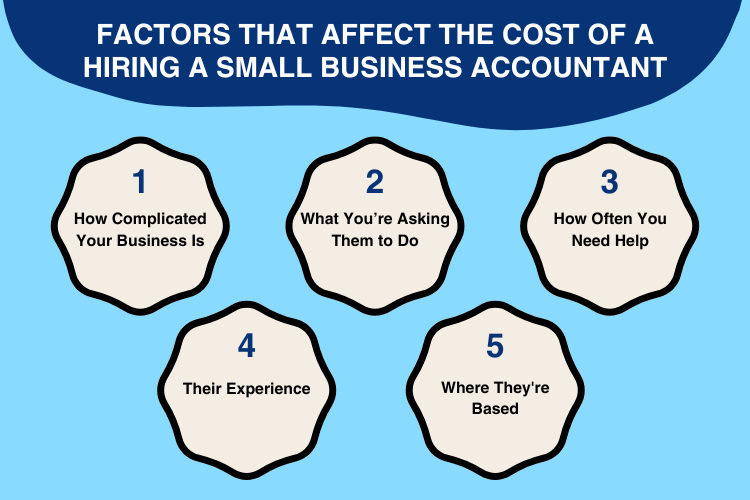

What Affects the Cost?

The short version? It depends. Some businesses just need help once a year. Others need ongoing support with payroll, GST, or staying on top of cash flow. Here’s what tends to push the price up (or down):

🧩 How Complicated Your Business Is

A one-person freelance setup is going to be simpler than a café with staff, suppliers, and stock to manage. The more going on behind the scenes, the more time it takes to sort out your numbers—and that’s going to cost more.

📋 What You’re Asking Them to Do

Are you just looking for someone to lodge your tax return? Or do you want regular bookkeeping, BAS submissions, payroll, and business advice? More work = more time = higher cost. No surprises there.

Here’s how the services usually stack up:

- Just tax returns – lower cost

- Quarterly BAS/GST help – somewhere in the middle

- Ongoing bookkeeping, strategy, and advice – expect to pay more

📅 How Often You Need Help

Once a year is obviously cheaper than every month. A lot of business owners start off with one-off help, then bring in monthly or quarterly support once things grow.

💼 Their Experience

An advisor who specialises in your industry or has years under their belt might charge more—but you’re also paying for their insight. Someone who understands your type of business can save you time, money, and a few headaches.

📍 Where They’re Based

CBD firms with big offices and staff tend to charge more than a solo operator working from home in the suburbs. Location still makes a difference, even in the world of cloud accounting.

What Are the Typical Prices in Melbourne?

Here’s what most businesses in Melbourne are currently paying for financial support, depending on what they need:

💰 Basic Tax Return (Sole Trader)

- Cost: From $300 – $600+

- Covers: Your personal and business income, standard deductions, and ATO submission.

📊 Quarterly BAS & GST Lodgements

- Cost: From $500 – $1,200+ per quarter

- Covers: Business Activity Statement (BAS), GST reporting, and lodgments.

📈 Ongoing Monthly Support

- Cost: From $500 – $2,500+ per month

- Covers: Bookkeeping, payroll, monthly reports, forecasting, tax planning, and general support.

🕒 Hourly Rates for Ad Hoc Help

- Cost: From $100 – $300+ per hour

- Used for: Fixing issues, giving advice, setting up software, or one-off tasks.

Every business is different, so some fall on the lower end of the scale, others on the higher. It depends on what you need—and how ready your books are when you hand them over.

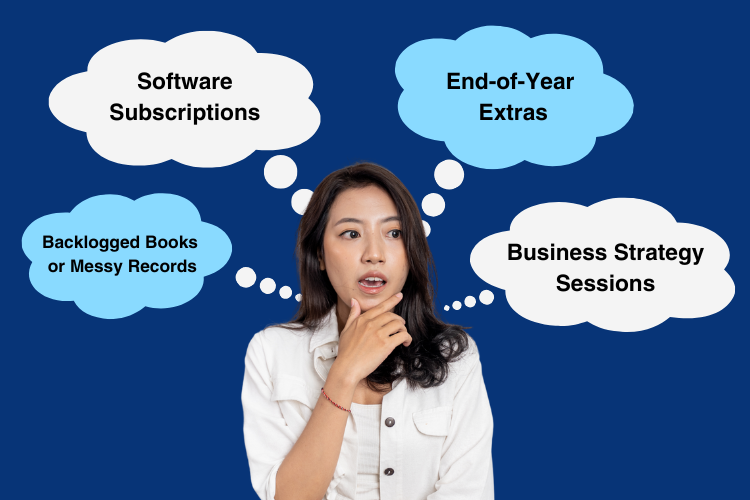

Extra Costs to Keep an Eye On

Not everything is included in a basic quote. Some things might show up later, especially if you haven’t chatted through the details upfront.

1. Backlogged Books or Messy Records

If you haven’t done much record-keeping and things are all over the place, expect to pay more for someone to clean it up. This is usually billed by the hour—anywhere from $100 to $250+ depending on how bad it is.

2. Software Subscriptions

Using platforms like Xero, MYOB, or QuickBooks? Those aren’t usually covered in your accountant’s fee. You’ll need your own subscription—expect to pay $30 to $100+ a month depending on the plan.

3. End-of-Year Extras

Things like depreciation, asset reconciliation, or prepping your books for an audit can be billed separately. They’re often not included in regular monthly or quarterly packages.

4. Business Strategy Sessions

Need help picking the right structure, planning your growth, or navigating cash flow problems? Strategic advice like this is usually charged on top of your regular fees.

How to Keep the Cost Down

You don’t have to spend a fortune to get good financial help. Here are a few smart ways to stretch your budget:

- Get a bundled package: It’s often cheaper to pay a set monthly fee than to be charged separately for every little thing.

- Be organised: When your receipts and records are in good shape, your advisor can work faster—which means fewer hours billed.

- Use cloud accounting: Software like Xero and QuickBooks helps your accountant work more efficiently (and you’ll always know where your numbers stand).

- Ask questions upfront: The clearer you are on what’s included, the less likely you’ll get hit with surprise charges.

What Melbourne Business Owners Actually Look For

It’s not just about price. You want someone you trust. Someone who gets your business. Someone who picks up the phone when you need them.

Here’s what people really care about when choosing a financial pro:

- Straightforward advice: No confusing reports. Just clear answers.

- Industry know-how: If they understand your type of business, they’ll spot risks and opportunities you might miss.

- Good communication: You want updates, not silence.

- Clear pricing: You should know exactly what you’re paying for.

Conclusion

Sorting your finances isn’t something you want to leave to chance—or to the last minute. The right financial expert can help you make smarter decisions, avoid costly mistakes, and feel more in control of your business.

Yes, there’s a cost involved. But it’s not just an expense—it’s an investment in running your business well. With the right help, you’ll spend less time worrying about numbers and more time doing what you do best.